🔥 Get Your $1000 Gift Card Instantly! 🔥

🎉 1 out of 4 wins! Claim your $1000 gift card in just 1 minute! ⏳

💎 Claim Now 🎁 Get $1000 Amazon Gift Card Now! 🎯

🎉 1 out of 4 wins! Claim your $1000 gift card in just 1 minute! ⏳

💎 Claim Now 🎁 Get $1000 Amazon Gift Card Now! 🎯

🎉 1 out of 4 wins! Claim your $1000 gift card in just 1 minute! ⏳

💎 Claim Now 🎁 Get $1000 Amazon Gift Card Now! 🎯

3 Top Dividend Stocks I Just Bought as the Stock Market Corrected

Stock market corrections (a decline of 10% or more from the recent high) can be a gift to dividend-seeking investors. As stock prices fall, dividend yields rise, enabling investors to lock in higher yields on many top dividend stocks.

I’ve been capitalizing on the recent stock market correction by buying more shares of many of my favorite dividend stocks. Among those I recently purchased were Blackstone (NYSE: BX), Starbucks (Nasdaq: Sbux)and Verizon (NYSE: VZ). Here’s why I think they’re great dividend stocks to buy right now.

Private equity giant Blackstone has lost nearly 30% of its value from the recent peak. That sell-off has driven its dividend yield up to 2.8%, more than double the S&P 500‘s current yield of 1.3%.

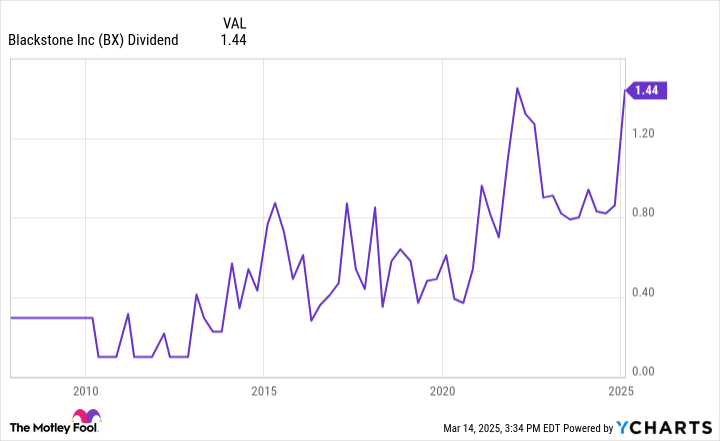

Blackstone isn’t your typical dividend stock. It doesn’t pay a fixed quarterly dividend like most companies. Instead, the leading alternative asset manager returns the bulk of its distributable income to investors each quarter via dividends and share repurchases. As a result of that dividend policy, its payment can fluctuate, sometimes significantly:

However, the payout has been on a generally upward trajectory over the past decade and a half. I expect the rising trend will continue as Blackstone grows its assets under management (AUM)fee-based income, and performance revenues.

Driving that view is the expectation that investors will continue to increase their allocations to alternative investments like private equity, real estate, and credit because they tend to generate higher returns with lower volatility than the public stock and bond markets. According to a forecast by Preqin, the global alternatives market will hit $30 trillion by 2030, up from $17 trillion at the end of 2023.

That growth should benefit Blackstone’s leading alternative franchises. With Blackstone’s stock down sharply amid the market sell-off, I could potentially earn an attractive total return as its price recovers and its dividend rises.

Starbucks stock has slumped about 15% from its recent high, which has driven the coffee giant’s dividend yield up to 2.5%. Since initiating its payout, the company has delivered caffeinated dividend growth. Starbucks has increased its payment for 14 straight years, growing the payout at an impressive 20% compound annual rate.

Despite the seemingly ubiquitous nature of Starbucks stores, the company has plenty of room to continue expanding. It currently has more than 40,000 stores around the world. While the company has cut back on its initial plans to open 17,000 new stores by 2030, it still intends to open many new locations in the coming years.

🎁 You are the lucky visitor today! You won a FREE $1000 gift card! 🎁

⚡ Hurry up! This offer is valid for today only! ⚡

Claim Now 💰 Get Amazon Deals 📢