Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

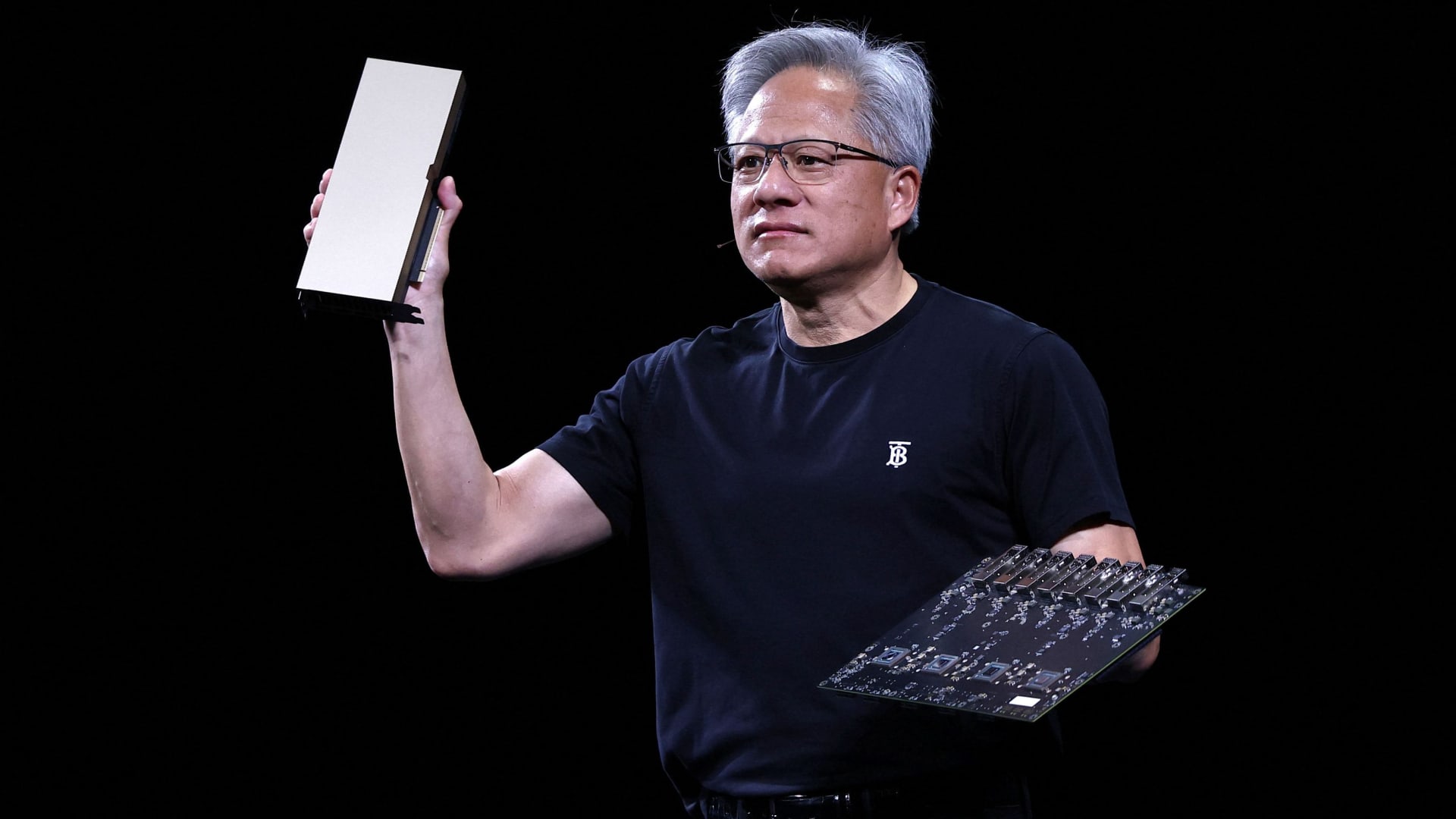

Jensen Huang, CEO of NVIDIA, holds a motherboard while he is talking during the Viva technology conference dedicated to innovation and startups of the Porte de Versailles exhibition center in Paris, France, June 11, 2025.

Gonzalo Fuentes | Reuters

Nvidia Actions increased by more than 4% on Wednesday and closed in a record for the first time since January, because investors trust that company leadership in artificial intelligence will not be reduced by Chinese export controls.

The action ended at $ 154.31, exceeding its anterior fence top of $ 149.43 on January 6.

NVIDIA is now worth 3.77 billions of dollars, making it the largest company in the world by market capitalization, slightly beating MicrosoftOne of its main customers. Apple is third at around 3 billions of dollars.

While Nvidia remains the clear leader in graphic processing units (GPU) which are used to build major language models and execute IA workloads, the strength of this year’s gathering is surprising since the company said it was excluded from the second world economy.

In April, the Trump administration published new rules cut sales IA H20 processor of the company that had been developed to respond to previous restrictions. NVIDIA said last month that the Change instituted by the United States government would cost the company $ 8 billion in sales and that it was to delight $ 4.5 billion in inventory. Nvidia is not counting on the sales of China.

“The Chinese market of $ 50 billion is actually closed to American industry,” said Jensen Huang, CEO of Nvidia said last month.

And there is another upcoming rule that will expand the export restrictions on AI fleas, Trump administration officials said.

However, in his Gains report In May, Nvidia declared a 69% increase in income from one year to the next, fed by an increase of 73% of its data center activity. For the full financial year, analysts expect revenue growth of 53% to almost $ 200 billion, according to LSEG.

Nvidia held her Annual shareholder meeting Wednesday. Huang said During the event, apart from AI, robotics is its greatest growth opportunity.

WATCH: You cannot play with the three riders – Nvidia, Broadcom and TSMC