Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

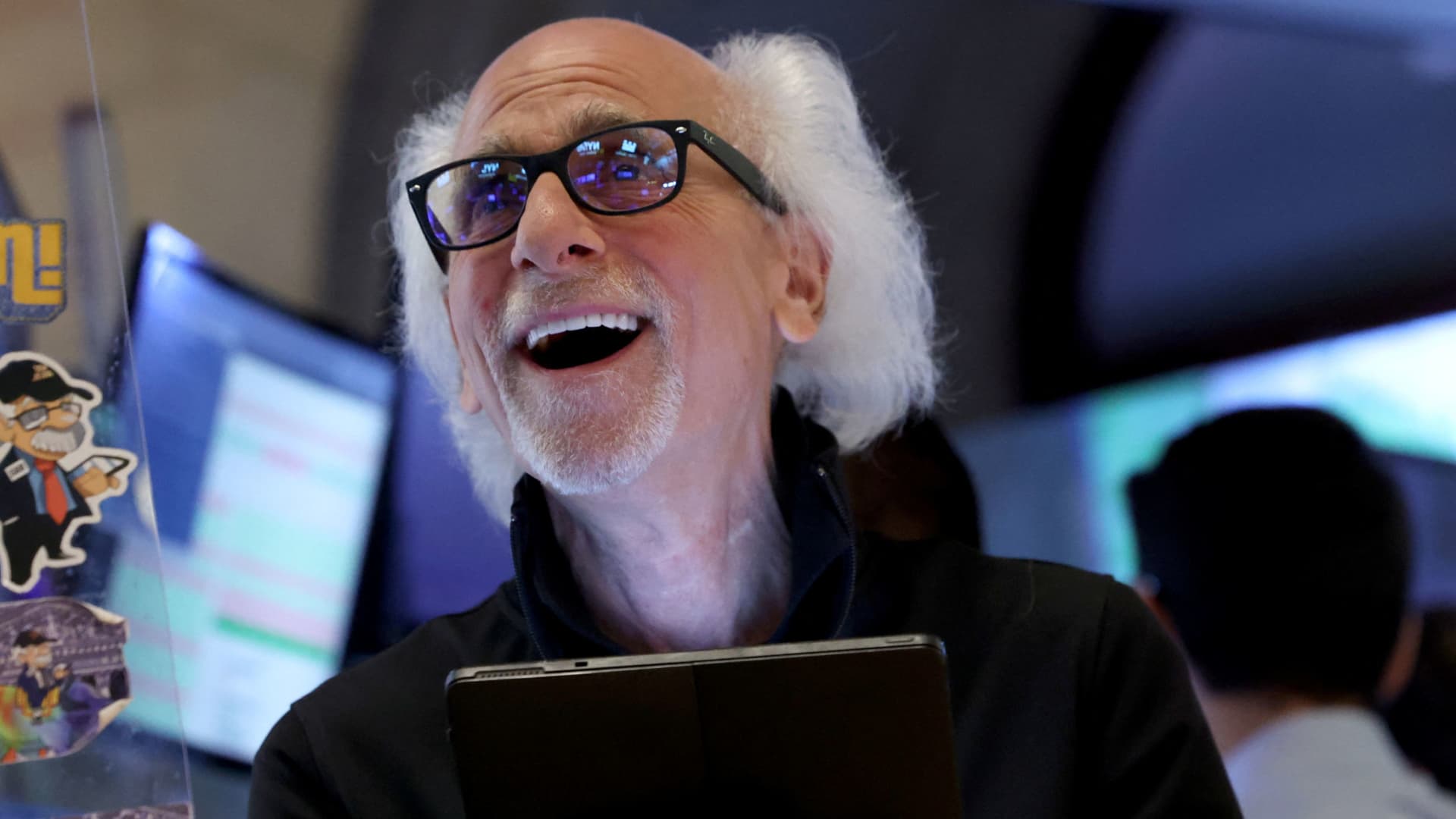

Merchants work in the field on the New York Stock Exchange (NYSE) in New York, United States, June 23, 2025.

Brendan McDermid | Reuters

Have we returned over time? It certainly seems on the market front. Just look at it S&P 500 And you will think that it is back in February – in front of the “reciprocal” prices of the American president Donald Trump, in front of “One Big Beau Bill Act” of the White House, and before the war between Israel and Iran.

On February 19, the broad index closed at a top of all time 6,144.15. Yesterday, that completed the negotiation session at 6,092.16. It is a difference of less than 1%. A light breeze (or a stoveing social networks of the American president seated) could push the S&P 500 beyond this level.

In another sign, investors seemed to be back in the days preceding trade and geopolitical uncertainty, Nvidia Again in titles after jumping 4.3% to close to a new High, a symbol of optimism surrounding artificial intelligence which led a large part of the 2024 market gains.

What is strange is that the market seems to have raised its heavy load shoulders that have been weighing it since March.

Price concerns still persist. Trump threatened on Wednesday, threatened Spain that it “would make them pay twice as much” in a trade agreement because the European country resists an increase in defense spending.

The war between Israel and Iran, although currently interrupted thanks to a ceasefire, is not ended in a conclusive manner. And this truce seems fragile – it was almost broken Only a few hours after entering the game. Who knows how the discussions planned in the United States with Iran next week take place. (I hope not as bad as the Cry match in the oval office When Ukrainian President Volodymyr Zelenskyy was there.)

Nostalgia is attractive. But this look can be dangerous.

The S&P 500 is at the dawn of a new summit. The index, however, finished little on Wednesday changed. Technological stocks have increased, with Many strike intrajournal heights. THE Stoxx Europe 600 The index dropped by 0.74%, despite European defense stocks climb to the news of a NATO agreement.

Trump threatened Spain with a difficult commercial agreement. The American president Make these comments At the annual NATO summit after the allies of the Alliance – with the exception of Spain – agreed to meet a Defense expenditure target of 5% gross domestic product by 2035.

Tesla sales in Europe plunged in May. Elon Musk’s electric vehicle company has recorded a 27.9% decrease in annual shift sales Within the European Union, Great Britain and the European Free Trade Association, while consumers in the region have gone to Chinese electric vehicles.

Nvidia is again the most precious business. Shares jumped 4.3% on Wednesday and Record closed – The first time, that has done so since January. The market capitalization of the flea manufacturer is now 3.77 billions of dollars, passing in front of Microsoft and Apple.

[PRO] Investors hold their breath. The American market seems surprisingly resilient to exchange friction and geopolitical instability. In fact, the S&P 500 seems on the right track to close a new record. But The risks that could make it fall.

The British book is widely planned to continue to increase compared to the US dollar.

Matt Cardy | Getty images

What is the next step when the British book has been hitting its highest for over three years?

THE British book Hen at its highest level in more than three years – and analysts are divided on the potential of the increase.

According to Janet Mui, responsible for market analysis at RBC Brewin Dolphin, a large part of the ascending trajectory of the book has more to do with the weakness of the underlying dollar than the faith in sterling itself.

In addition, the prospects of the British book are not too convincing in the coming months, said MUI, but noted that geopolitical developments could further catalyze movements upwards in the longer term.

– Chloe Taylor