Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

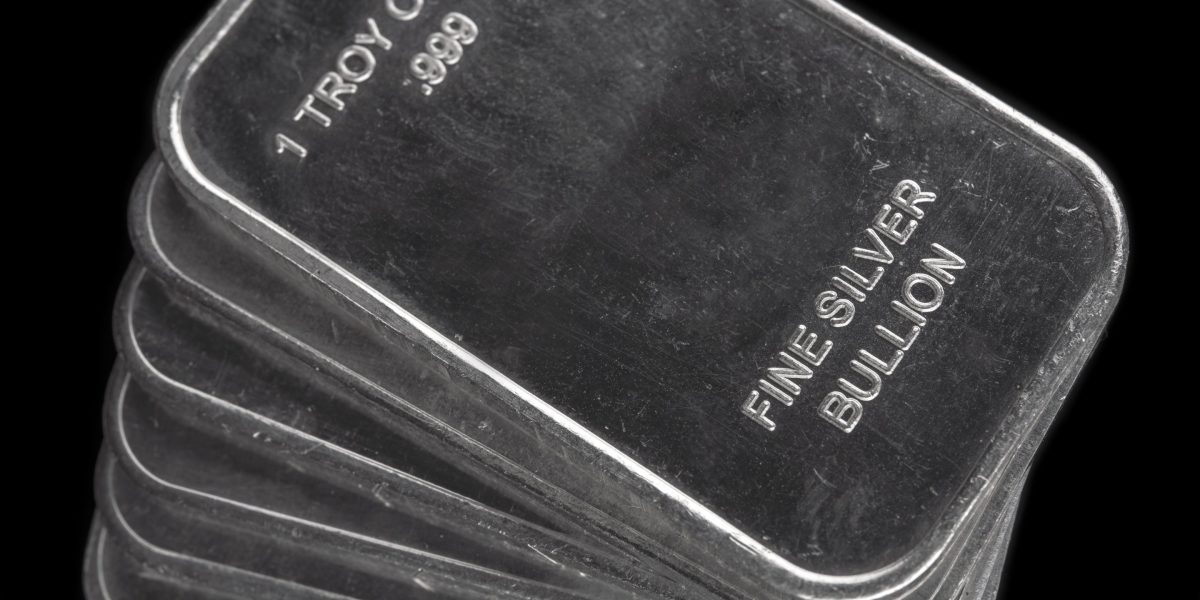

As markets reopened Friday after the Christmas holiday, U.S. stocks were little changed, but precious metals saw plenty of action.

Silver prices jumped 9.6% to $78 per ounce for the first time ever. Gold rose 1.3% to a new record high of $4,561 an ounce, and platinum jumped 10.5% to its own high, while palladium jumped 13%.

So far this year, silver has soared 169%, platinum 172% and palladium 124%, all easily outpacing gold’s 73% year-to-date gain, as well as Nvidia’s 42% rise and the S&P 500’s 18% advance.

The last gathering took place after US launches strikes against Islamic State targets in Nigeria Thursday, adding to other geopolitical tensions.

Earlier in the week, the Trump administration continued to put more pressure on Venezuela by targeting more oil tankers, reducing a key source of revenue for Maduro’s regime.

Meanwhile, the Pentagon has sent large numbers of special operations aircraft, troops and equipment to the Caribbean, sources told the The Wall Street Journal.

The additional military assets join a flotilla of Navy ships that has been building in the region for months, as President Donald Trump suggests that U.S. attacks will soon expand from suspected drug boats to land targets.

Faced with the threat of a new regional conflict, investors sought safe havens. At the same time, debt concerns have made precious metals appear safer than other assets like the dollar and yen.

Robin Brooks, a senior fellow at the Brookings Institution, said in Sunday sub-stack post that the so-called depreciation trade has returned with a vengeance, highlighting that precious metals began galloping higher after Fed Chairman Jerome Powell hinted at rate cuts over the summer.

“First, this trade is clearly triggered by Fed easing and debt monetization concerns,” Brooks wrote. “After all, Chairman Powell’s conciliatory speech at Jackson Hole on August 22 and the Fed’s latest rate cut on December 10 were big catalysts for the precious metals takeoff.”

As the United States and other major economies head toward increasingly unsustainable debt levels, investors fear those governments will let inflation run high and erode the value of their bonds to ease the burden, rather than rein in deficits.

This devaluation trade is not only manifesting itself in precious metals, Brooks added, pointing out that countries with low levels of public debt, such as Switzerland or Sweden, have seen their currencies move in tandem with gold and silver prices.

“It is remarkable that Sweden is the center of attention. The krona has traditionally been a very volatile currency that did not have a safe-haven attribute. The devaluation trade is changing that,” he explained.

Similarly, market veteran Ed Yardeni attributed the rise in precious metals to concerns about excessive stimulative effects of U.S. monetary and fiscal policies next year.

Indeed, Wall Street expects more rate cuts from the Federal Reserve, which is also buying bonds again, while consumers will begin to notice Trump’s tax cuts. Trump also raised the possibility of “tariff dividend” controls, although Congress would have to approve them.

“Regardless, the federal budget deficit could increase significantly in the first four months of 2026, which could prompt Bond Vigilantes to increase Treasury yields, causing a stock market correction,” Yardeni said in a note Monday.