Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

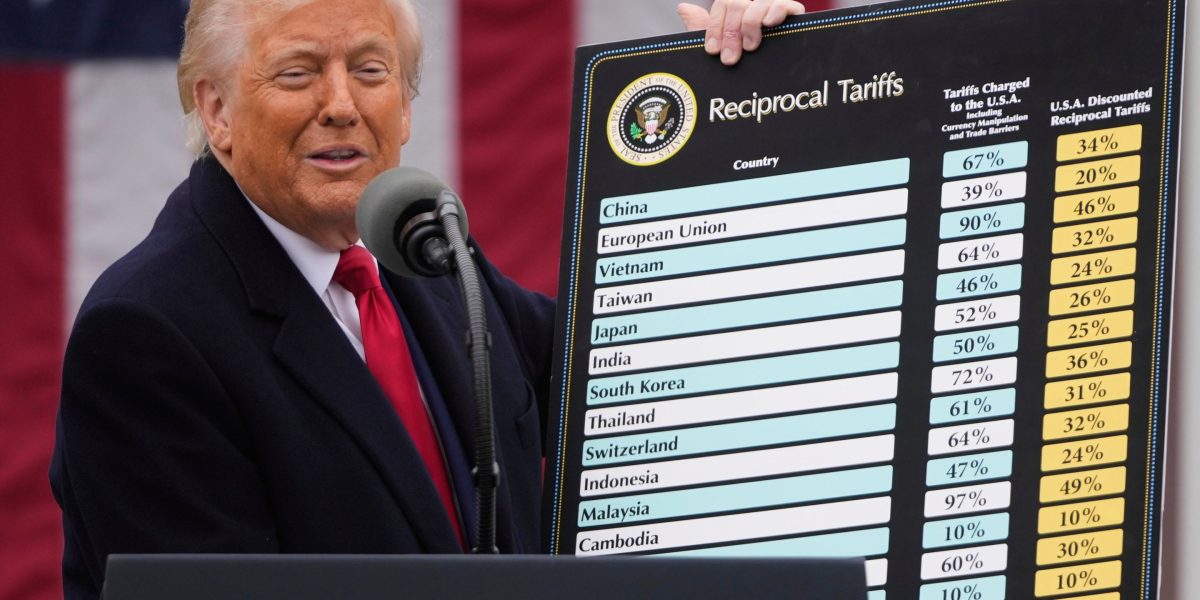

Since his return to the White House in January, the president Donald Trump upended decades of U.S. trade policy by erecting a wall of tariffs around what was once a largely open economy.

Its double-digit taxes on imports from nearly every country have disrupted global trade and strained the budgets of consumers and businesses around the world. They also raised tens of billions of dollars for the US Treasury.

Trump has argued that his new high taxes on imports are necessary to bring back the wealth that was previously “stolen” of the United States, he says they will reduce the decades-old U.S. trade deficit and bring manufacturing back to the country. But upending the global supply chain has proven costly for households faced with rising prices. And the erratic way in which the president has rolled out his tariffs — announcing them, then suspending or modifying them before bringing up new ones — has made 2025 one of the most turbulent economic years in recent memory.

Here’s a look at the impact of Trump’s tariffs over the last year, in four charts.

A key number for the overall impact of tariffs on American consumers and businesses is the “effective” tariff rate – which, unlike the general figures imposed by Trump for specific trade actions, provides an average based on actual imports entering the country.

In 2025, according to data from the Yale Budget Lab, the effective U.S. tariff rate peaked in April. But this remains well above the average observed at the start of the year. Before finalizing the consumer changes, November’s effective tariff rate was nearly 17%, seven times the January average and the highest since 1935.

Among the selling points to justify his tariffs, Trump has repeatedly said they would reduce America’s long-standing debt. trade deficit and bring revenue to the Treasury.

Trump’s higher tariffs are certainly a money-raiser. They have raised more than $236 billion this year through November, far more than in previous years. But they still represent only a fraction of the federal government’s total revenue. And they didn’t raise enough to justify the president’s decision. claim that tariff revenues could replace federal income taxes – or enable exceptional dividend checks for Americans.

The American trade deficit, for its part, has been reduced considerably since the start of the year. The trade deficit peaked at a monthly record of $136.4 billion in March, as consumers and businesses in a hurry to import foreign products before Trump can impose his tariffs on them. The trade gap narrowed to $52.8 billion in September, the latest month for which data is available. But the annual deficit was still 17% compared to January-September 2024.

Trump’s 2025 tariffs affect almost every country in the world, including the United States’ largest trading partners. But it is his policies that have had the greatest impact on U.S. trade with China, once the largest source of U.S. imports and now third behind Canada and Mexico. US tariffs on Chinese imports now reach 47.5%, according to calculations by Chad Bown of the Peterson Institute for International Economics.

The value of goods entering the United States from China fell nearly 25% in the first three quarters of the year. Imports from Canada also fell. But the value of products from Mexico, Vietnam and Taiwan has increased since the start of the year.

For investors, the most volatile moments in the stock market this year have come amid some of the most volatile moments related to Trump’s tariffs.

The S&P 500, an index of the largest public companies in the United States, saw its biggest daily and weekly swings in April – and its biggest monthly losses and gains in March and June, respectively.

Need a recap of how Trump’s trade actions have fared in 2025? See a timeline here.