Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

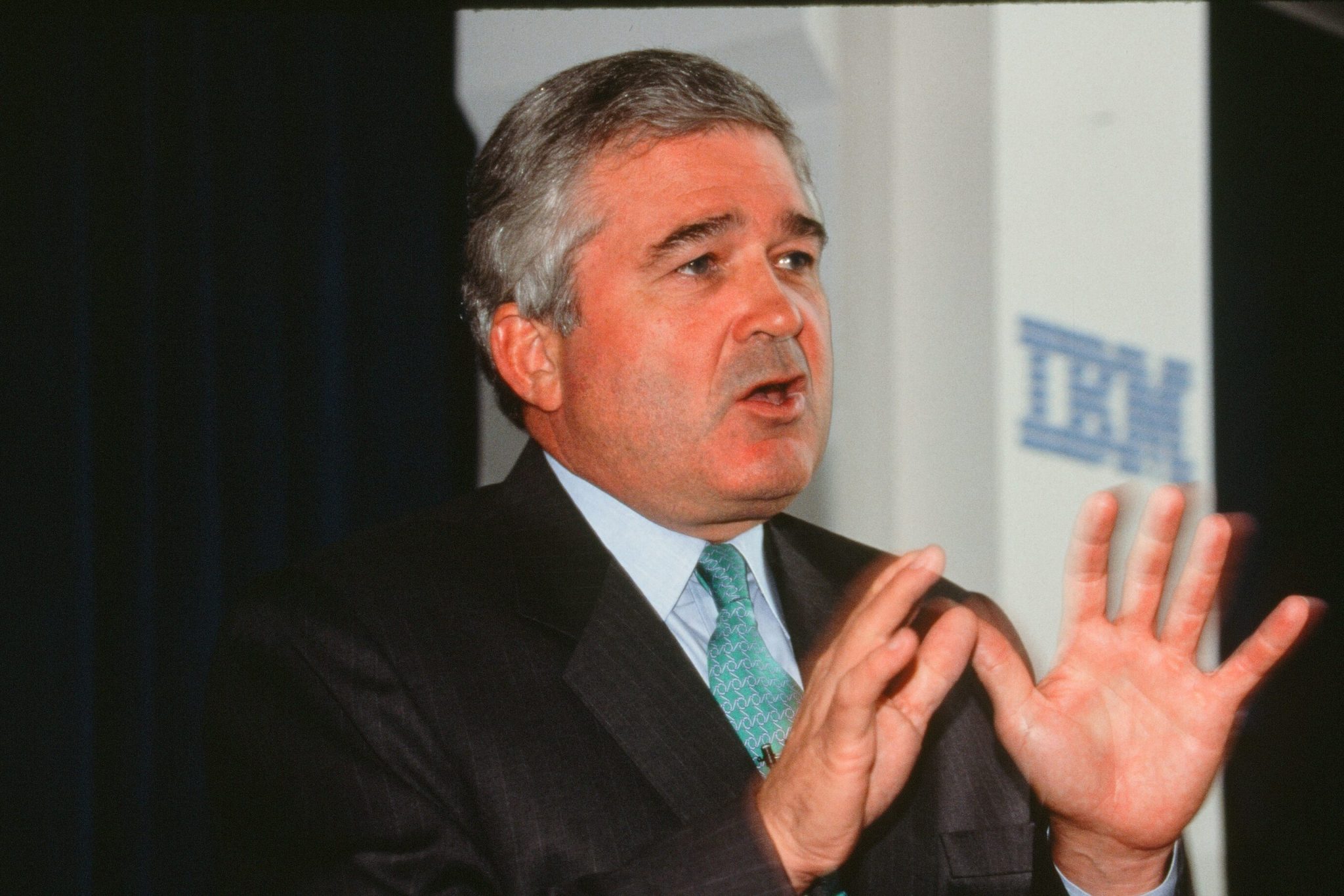

Louis Gerstner, who took over International Business Machines Corp. while on his deathbed and resurrected him as a leader in the technology industry, died on Saturday. He was 83 years old.

IBM Chairman and CEO Arvind Krishna announced Gerstner’s death in a e-mail sent to its employees on Sunday, but did not provide a cause of death.

Gerstner’s nine-year tenure as chairman and CEO of the company known as “Big Blue” is often used as a case study in business leadership.

On April 1, 1993, he became the first outsider to head IBM, which was facing the choice between bankruptcy or breakup after a period when the company was the undisputed leader in personal and mainframe computers. He shifted the Armonk, N.Y.-based company’s focus toward business services and away from computer hardware production, reversing a move to break up the company into a dozen or more semi-autonomous units — “Baby Blues” — in search of greater profits.

Gerstner cut costs and sold off unproductive assets, including real estate and IBM’s art collection. He laid off 35,000 of 300,000 employees, accustomed to a tenure-for-life culture based on principles established by former CEO Thomas Watson Sr. in the early 20th century.

He emphasized company-wide teamwork to replace the tradition of loyalty to individual divisions, and he set compensation on company performance rather than individual results. To achieve performance goals, he emphasized regular accountability rather than waiting for annual performance reviews.

“People do what you inspect, not what you expect,” he says. said.

Gerstner’s key change was abandoning IBM’s culture of selling bundled products that only worked with other IBM products, from PCs to operating systems to software. Products he considered losers were discontinued. He unplugged the plug on OS/2, an operating system intended to compete with Microsoft’s Windows which had not been appreciated by customers.

“His leadership during this period reshaped the company,” Krishna wrote. “Not by looking back, but by relentlessly focusing on what our customers would need next. »

IBM focused on what is called middleware — software for databases, systems management and transaction management. The company has become the impartial integrator of enterprise networks and systems, happy to help, whether or not the hardware used bears the IBM name.

Gerstner made an early bet on the Internet and e-commerce, which he believed would place less emphasis on personal computers and more on servers, routers and other more sophisticated equipment that would benefit from IBM’s services expertise and involve buyers familiar with IBM’s sales force, such as technology directors.

Later in his tenure, he also made some strategic acquisitions such as the $2.2 billion paid for Lotus Development Corp., whose Notes product was key to helping IBM clients collaborate enterprise-wide.

The shift from hardware to services led to an increase in services revenue from $7.4 billion in 1992 to $30 billion in 2001. IBM’s stock price rose from $13 to $80 during his nine years as CEO, adjusted for splits, and IBM’s market value rose from $29 billion to about $168 billion during that period.

“If I had a vote, the most important legacy of my tenure at IBM would be the truly integrated entity that was created,” he wrote in Who said elephants can’t dance? Leading a large company through radical change (2002). “It was definitely the hardest and riskiest change I’ve made.”

Louis Vincent Gerstner Jr. was born March 1, 1941, in Mineola, New York, to Louis Gerstner Sr., a milk truck driver, and Marjorie Rutan, a secretary and college administrator. He was one of four brothers.

He graduated from Chaminade High School in Mineola, a competitive Catholic institution. He holds an engineering degree from Dartmouth College and an MBA from Harvard University.

After Harvard, he joined McKinsey & Co. as a consultant. He became a partner in four years and spent 12 years there before taking a job at American Express.

There he worked for the credit card industry and then took charge of travel-related services. Under his leadership, Amex, which then primarily offered a travel card, increased its presence in retail stores and created premium cards that allowed customers to keep their outstanding balances.

With his path to the top management of Amex blocked by CEO James D. Robinson III, Gerstner agreed to lead RJR Nabisco Inc., where he stayed for four years before joining IBM. His main goal at RJR Nabisco was to reduce the $25 billion in debt produced by the leveraged buyout that gave birth to the tobacco and consumer products company.

IBM’s board began searching for a new CEO after ousting John Akers in January 1993, just as the company posted its largest annual loss. In selecting Gerstner, the board chose management experience over IT expertise. (Gerstner’s brother, Richard, had worked for IBM for 30 years and headed the division that included personal computers.)

From Gerstner’s first day in April 1993 until his resignation announcement in January 2002, IBM’s shares rose ninefold while the Standard & Poor’s 500 Index gained 154 percent. Sam Palmisano succeeded him, first as CEO, then as president when Gerstner retired at the end of 2002.

In 2003, Gerstner became president of Carlyle Groupthe Washington-based private equity firm. He oversaw the company’s expansion into Asia and Latin America as well as early preparations for its IPO, which it did in 2012. He retired in 2008, remaining as a senior advisor.

He had two children with his wife Robin. Their son, Louis III, died in 2013 following a choking accident in a restaurant.

Through Gerstner Philanthropiesthe family supported biomedical research, environmental and educational programs, and social services in New York, Boston, and Palm Beach County, Florida. The family has long supported the Mayo Clinic.