Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

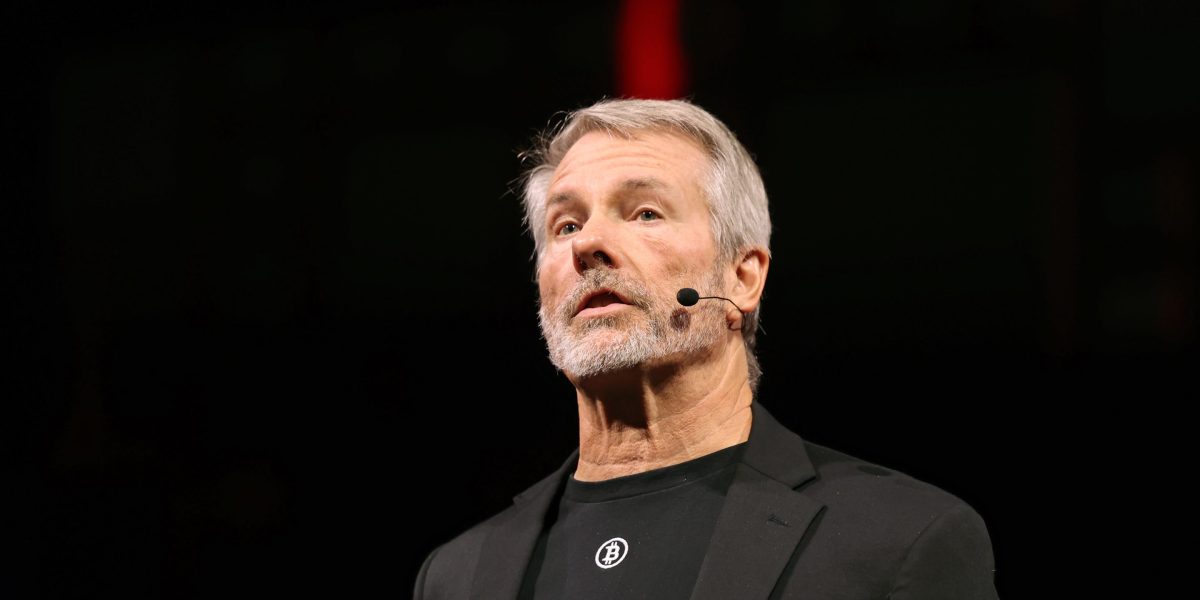

Shares of Michael Saylor’s Bitcoin cash company Strategy rose 1.22% in early trading today, giving the company a brief period of relief. The stock has fallen 66% since its high last July, and this morning its “mNAV” – a technical measure of whether the company is worth more or less than the Bitcoin it holds – was at 1.02.

If this gauge falls below 1, then technically the company is worth less than the Bitcoin it owns. At this point, the stock would be sold by many investors, as there is no point in owning a stock whose value is based on Bitcoin if the stock is worth less than Bitcoin.

The title is above this danger zone since November.

Already, the company’s market capitalization is worth less than its Bitcoin. Its market capitalization today was $47 billion; the Bitcoin owned by the company is worth just under $60 billion. This in itself is a perilous position. But if the company’s mNAV (“market value to net assets”) falls below 1, then the stock potentially enters a new world of pain. mNAV is a measure of the company’s total market capitalization plus its debt, minus its cash, divided by its total Bitcoin reserve. If this value is less than 1, then the case for owning Strategy stock becomes more difficult to argue.

Fortune has contacted the company for comment.

Saylor, as usual, tweeted bullishly about MSTR stock, including this painting showing that “open interest” (investor positions that have not been liquidated) is the equivalent of 87% of the company’s market value. The implication is that the stock is heavily traded (although many of these positions are undoubtedly short bets against the company). He also posted an AI-generated photo of himself. tame a polar bear.

Below the mNAV level of 1 is another dangerous threshold for Strategy: the average price at which Strategy has historically accumulated Bitcoin. Over the years, this price was around $74,000 per piece. Currently, Bitcoin is trading at $89.6k. If the price were to fall below $74,000, it would imply that Strategy’s Bitcoin stash was worth less than what Saylor paid for it.

Strategy enthusiasts would say that now might be the time to buy: if the stock was worth less than its Bitcoin, the price per share could rise to the price of Bitcoin; it could rise even further if Bitcoin resumes its upward march.

But this, again, would be a painful test for traders who are not true believers. Why hold a stock that is worth less than the underlying asset it represents?