Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

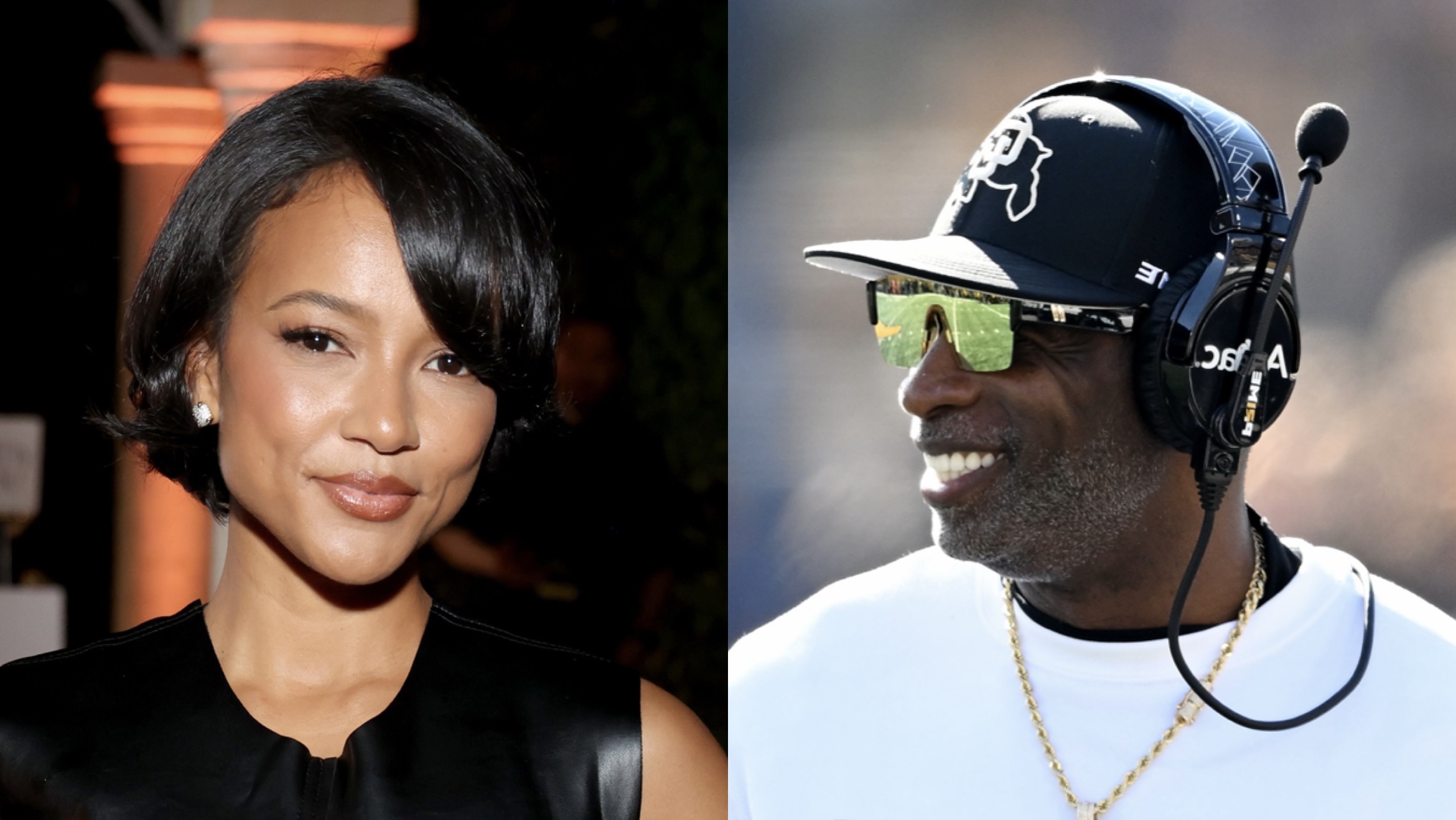

Pictures show Karrueche Tran And Deion Sanders go shopping for their end-of-year celebrations.

Wednesday December 31 pictures titled “Shopping With Coach Prime: It’s A Lite Day” was uploaded to Well Off Media’s YouTube channel. Additionally, the footage largely showed Karrueche Tran alongside her “step-son” and other members of Coach Prime’s family.

Specifically, around the 10-minute mark of the clip, viewers watched Tran and Sanders head to the grocery store to secure goods for the family’s apparent New Year’s celebration.

Check out the images below.

Social media users reacted to the clip of Karrueche Tran and Deion Sanders shopping for their holiday festivities in TSR comments section.

Instagram user @its_ericckkaa_ wrote: “Her sister started dating Unk and hasn’t needed to put on real clothes, do her hair or makeup since. I love that for her”

While Instagram user @breyrenayy added, “I love this for her! My sister has a Paw Paw 😍😍🔥 »

Instagram user @rozaymylanofficial wrote: “They complement each other very well ❤️ and Prime doesn’t look his age ‼️”

While Instagram user @themschapman added, “they go well together..once you reach 35 it’s different…❤️”

Instagram user @iamcalisodope wrote: “for the age difference, they fit together quite well, she is mature. I like it”

While Instagram user @prettychaoss__ added, “She’s really dating a guy 😂😍”

Instagram user @living_in_chocolate wrote: “I’m just going to mind my own business because I like my man well seasoned like that lol 50 and over please 😂”

While Instagram user @alwayzthevibe added, “Their relationship CRIMES the sweet life. 😍 So I’ll support her and mind my own business.

Instagram user @millieyonn wrote: “I like them together. 2026, we’re dating the dads and grandpas with the 401K and believing in old school values. 😂”

Before holiday shopping, Karrueche Tran and Deion Sanders made headlines by dropping their first photo on the ‘gram. As The shadow room Previously reported, earlier this week, Sanders took to his Instagram Story to share a photo of him and Tran seemingly on a private jet. Of course, the couple was all smiles.

What do you think of roommates?